How Much Does Shopify Take Per Sale? 2025 Costs Explained

May 6, 2025

Understanding Shopify's Fee Structure: The Real Numbers

When you're thinking about selling on Shopify, understanding its fee structure is essential for planning your business’s profitability. It's not enough just to know the fee amounts; you also need to understand how those fees affect your net income as your business expands. Let's analyze the main elements of Shopify's fees per sale.

Basic Transaction Fees: The Foundation

Shopify charges a fee for every sale you make. This fee structure typically includes a percentage of the sale plus a flat transaction fee. Think of it like renting a space at a craft fair. You pay a percentage of your sales to the fair organizer, plus a flat fee for the booth itself.

This basic structure exists across all Shopify plans, but the exact percentages and flat fees differ. For online transactions on the Basic plan, the standard structure involves both a percentage and a flat fee. In-person sales, made through Shopify POS (Point of Sale), have a different, generally lower, percentage and flat fee.

Shopify Payments vs. Third-Party Processors

Your choice of payment processor is a key factor influencing Shopify’s per-sale fees. Shopify Payments, the platform's built-in payment gateway, provides a streamlined approach. However, some merchants opt to use third-party processors like PayPal or Stripe.

This decision has major financial implications. Using third-party processors might seem easier at first, but Shopify adds a penalty fee on top of the processor's own fees for any transactions not processed via Shopify Payments. This can significantly impact your profits.

As of 2025, Shopify’s Basic plan charges merchants 2.9% + $0.30 per online transaction. In-person sales cost 2.6% + $0.10. If you process $50,000 in monthly online sales through Shopify Payments on the Basic plan, you'll pay $1,600 in fees. Using a third-party processor adds a 2% penalty, raising your overall costs. International or American Express transactions have higher rates at 3.9% + $0.30, affecting international sellers in particular. You can find further information here: Shopify Transaction Fees Explained. This emphasizes the importance of carefully evaluating your payment processing choices.

You might also find this helpful: How to see how much a Shopify store makes. Understanding these details will help you accurately estimate your potential earnings and pick the best payment strategy for your business.

Projecting Your Costs: Real-World Examples

Understanding the fee structure in theory is useful, but concrete examples are more impactful. Consider a merchant selling a product for $50. With 500 sales per month on the Basic plan, the fees add up quickly. These seemingly small percentages can become substantial costs, particularly as sales grow. This shows why it's important not just to understand the fee structure, but also how it scales with your business.

The Hidden Costs of Third-Party Payment Processors

Understanding Shopify’s basic fees is important. But there’s another layer of cost to consider: third-party payment processors. While using familiar names like PayPal or Stripe might seem convenient, Shopify imposes additional fees for using these external gateways. This can significantly impact your profitability, especially as your sales volume increases.

Why the Extra Fees?

Shopify encourages the use of its own payment processor, Shopify Payments, by adding third-party payment processor penalties. This incentivizes merchants to stay within their ecosystem. These penalties vary depending on your Shopify plan. This means using an external processor adds another percentage-based fee on top of the processor’s existing fees, plus the standard Shopify transaction fees. This can quickly erode your margins.

Understanding the Penalty Structure

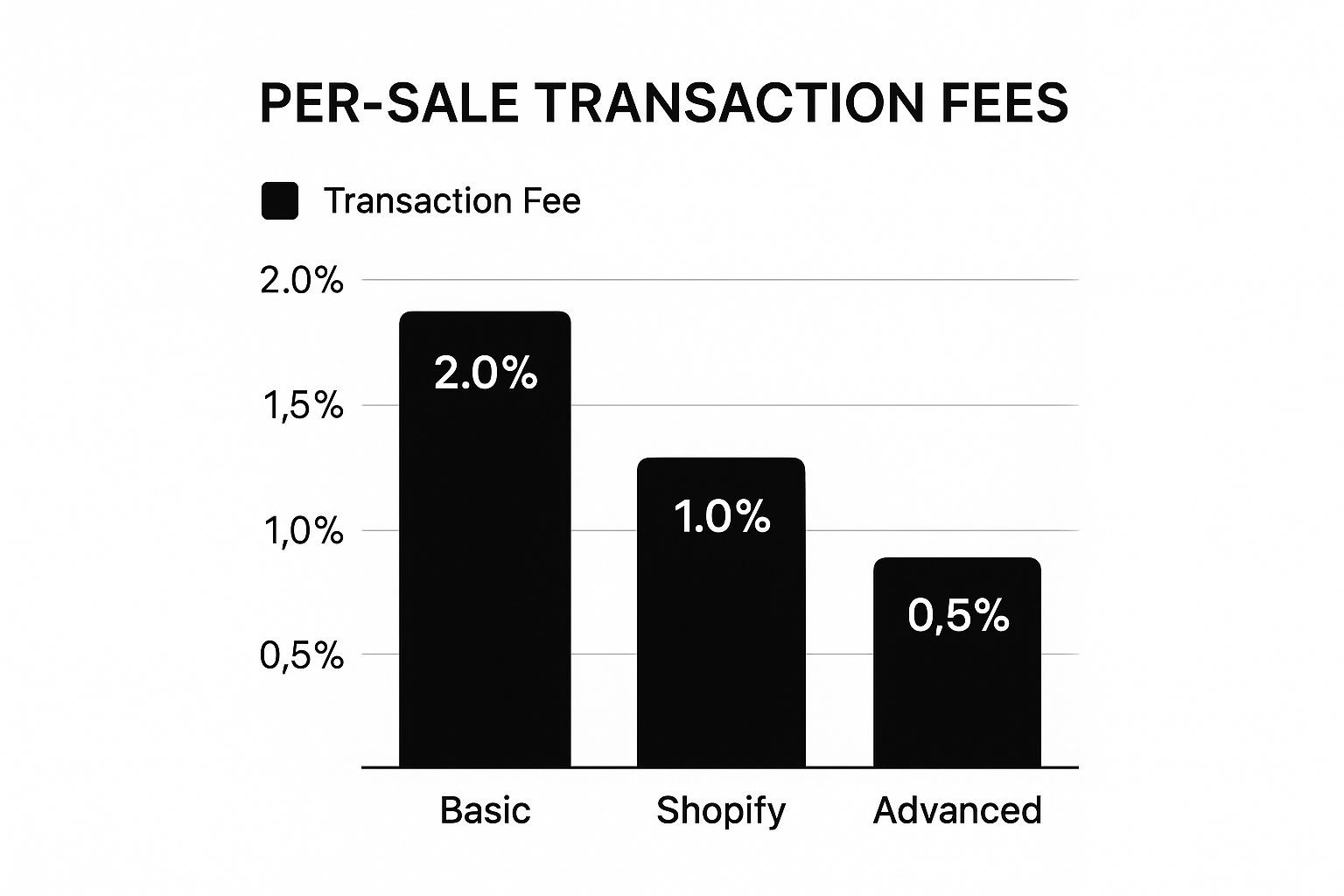

The impact of these penalties depends significantly on your sales volume and chosen plan. For example, on the Basic Shopify plan, the penalty can be as high as 2% per transaction. For a store processing $10,000 per month, this adds up to $200 in extra fees. However, the Advanced Shopify plan has a lower penalty of 0.6%, reducing the additional cost to $60 for the same sales volume. This difference highlights the importance of understanding how these fees scale as your business grows.

To illustrate the fee differences between plans, let's take a look at the following table:

Shopify Transaction Fee Comparison Across Plans

This table compares transaction fees and third-party payment processor penalties across all Shopify plans.

| Plan Type | Monthly Cost | Online Transaction Fee | In-Person Transaction Fee | Third-Party Payment Penalty |

|---|---|---|---|---|

| Basic Shopify | $29 | 2.9% + $0.30 | 2.7% + $0.30 | 2% |

| Shopify | $79 | 2.6% + $0.30 | 2.5% + $0.30 | 1% |

| Advanced Shopify | $299 | 2.4% + $0.30 | 2.4% + $0.30 | 0.5% |

As you can see, the Advanced Shopify plan, while having a higher monthly cost, offers lower transaction fees and a significantly smaller third-party payment penalty. This can lead to substantial savings for high-volume businesses.

Shopify’s fee structure penalizes merchants using external payment processors, with add-on fees ranging from 0.5% to 2% depending on the plan. The Advanced plan offers lower transaction fees (2.4% + $0.30 per online transaction) and a smaller 0.5% third-party penalty fee. This creates a significant cost difference compared to the Basic plan’s 2% fee. In-person transaction fees show similar stratification. This multi-layered pricing model encourages high-volume sellers toward premium plans, making the Advanced plan’s $299/month cost more justifiable at scale. Explore this topic further: Shopify Fee Structures.

Visualizing the Impact

The data chart below visually compares the total fees paid, including third-party processor penalties, across different Shopify plans at varying sales levels. It illustrates the growing disparity between plans as sales increase.

As the data chart demonstrates, the Basic Shopify plan might seem attractive initially. However, the added penalties make it less cost-effective at higher sales volumes. At $50,000 in monthly sales, the difference in total fees paid between the Basic and Advanced plans, when using a third-party processor, can be substantial.

Understanding Shopify’s fee structure is crucial. You can find an overview of different plans and associated costs on their dedicated pricing page: Shopify Pricing. Check out our guide on maximizing your Shopify store's benefits. This resource provides valuable insights into optimizing your Shopify experience.

Global Sales: The True Cost of International Expansion

Expanding your Shopify store internationally can significantly broaden your customer base and create exciting growth. However, going global introduces new complexities to your Shopify fee structure. Understanding how much Shopify takes per sale is crucial for healthy profit margins.

Navigating International Transaction Fees

International transactions typically have higher fees than domestic sales. Shopify charges a premium for processing payments in different currencies and across borders. These fees often range from 3.4-3.9% + $0.30 per transaction.

This is substantially higher than standard domestic rates. It requires careful consideration when setting your international pricing. For example, selling a $50 product internationally could mean paying close to $2 in transaction fees, impacting profitability.

Some payment methods, like American Express, might also have higher processing fees regardless of location. It's important to understand these nuances of international payment processing.

Successfully managing these increased costs involves strategic planning and understanding your target markets. Currency conversion rates, local taxes, and duties all influence your final profit. Thorough research and analysis are essential before expanding internationally.

In 2025, Shopify’s Advanced plan is the most cost-effective for international merchants. It offers 2.4% + $0.30 for domestic sales, while international and Amex transactions have higher fees of 3.4-3.9% + $0.30.

A merchant with $30,000 in monthly international sales would pay significantly more than one processing the same volume domestically. For more detailed information, check out this resource: Shopify Fees for International Sales. This difference highlights the impact of transaction type and volume on overall costs.

Pricing Strategies for Global Markets

Maintaining profitability with these higher fees requires adapting your pricing strategies. One approach is slightly increasing prices for international customers to offset the higher processing costs. This helps absorb the added expenses without significantly affecting profit margins.

Another strategy is tiered pricing based on shipping destinations. This gives you more control over your pricing structure and allows you to adjust your margins based on regional factors.

Multi-Currency Solutions: Balancing Cost and Benefit

Specialized multi-currency solutions can offer more control and potentially lower conversion costs. However, these come with their own subscription or usage fees.

Evaluating their cost-effectiveness means considering your sales volume and the currencies you use. For high-volume international sales, these tools might offer long-term savings.

For smaller businesses with limited international sales, the added cost might not be worthwhile. Carefully weigh the pros and cons based on your specific business needs. Knowing when to implement these solutions is key for maximizing your international growth strategy.

By strategically planning your expansion and adapting your pricing, you can successfully navigate the complexities of global sales and maintain a thriving Shopify business.

Beyond Transaction Fees: Your Total Shopify Investment

Transaction fees are only one factor to consider when calculating your Shopify expenses. To get a true understanding of your costs, you need to look at the total cost of ownership. This includes your monthly subscription, app fees, theme costs, and any other investments you make in your store, in addition to those per-transaction fees. A holistic approach to understanding these costs will give you a much better understanding of your profit margins.

Understanding Your Monthly Subscription

Your Shopify journey begins with choosing a plan. You have three options: Basic Shopify ($29/month), Shopify ($79/month), or Advanced Shopify ($299/month). Each plan has different transaction fees and features. The Basic plan might seem attractive initially, but the higher transaction fees can impact your profits as your sales increase. Choosing the right plan is crucial for long-term profitability.

The App Ecosystem: Adding Value and Cost

The Shopify app store is a treasure trove of tools to enhance your store. You can find apps for everything from marketing automation to advanced analytics. Some apps are free, but many have monthly or per-use fees. A premium email marketing app, for example, might cost $50/month, and an inventory management app could charge a percentage of your sales. Understanding your true operating costs requires factoring in these app fees. Look for cost-effective alternatives or free apps to help keep these expenses down.

Theme Customization: Investing in Your Brand

Your Shopify theme is the face of your online store. Free themes are available, but many merchants opt for premium themes. Premium themes provide enhanced design and customization options. These themes typically cost between $150 and $350, a significant upfront investment. However, a professional, well-designed theme can greatly enhance the customer experience and ultimately drive sales, making it a worthwhile investment.

Calculating Your Break-Even Point

When does upgrading your plan make financial sense? You'll need to calculate your break-even point. This is the point where the savings on transaction fees from a higher-tier plan offset the increased monthly subscription cost. For example, upgrading from Basic to Shopify might be cost-effective once you reach a specific sales volume each month. Knowing this break-even point helps you make strategic decisions about your Shopify plan. To boost your sales and make upgrades worthwhile, consider some of these tips for improving ecommerce sales.

Total Cost Calculator

To estimate your total monthly Shopify costs, use the table below as a starting point. Be sure to include all relevant costs, like your subscription, transaction fees (if applicable), app fees, and theme costs. This table helps merchants calculate their total monthly costs based on sales volume, transaction quantity, and plan choice.

Total Monthly Shopify Cost Calculator

| Cost Factor | Basic Plan | Shopify Plan | Advanced Plan |

|---|---|---|---|

| Monthly Subscription | $29 | $79 | $299 |

| Transaction Fees (Example: $10,000 in sales) | $290 + $30 (per transaction fees) | $260+ $30 (per transaction fees) | $240 + $30 (per transaction fees) |

| App Fees (Example) | $50 | $75 | $100 |

| Theme Cost (Amortized over 12 months – Example: $180 theme) | $15 | $15 | $15 |

| Estimated Total Monthly Cost | $404 + transaction fees | $449+ transaction fees | $664 + transaction fees |

This calculator provides a clear overview of potential costs associated with each plan, helping you budget effectively. Remember that these are estimates, and your actual costs may vary.

By understanding all aspects of your Shopify investment, you can make smart decisions about your plan, apps, and theme, ultimately boosting your profitability.

Strategic Plan Selection: Minimizing What Shopify Takes

Picking the perfect Shopify plan is crucial. It directly impacts how much Shopify takes from each sale, affecting your profit margins. It's not just about the monthly fee. It's about strategically balancing that fee against transaction costs to earn more. This section explores the break-even points where upgrading makes financial sense.

Analyzing the Break-Even Points

Switching from Basic Shopify ($29/month) to Shopify ($79/month) or Advanced Shopify ($299/month) might seem pricey at first. But the lower transaction fees on higher tiers can quickly balance out the increased monthly cost. It’s like choosing between a small booth with high commission at a market versus a larger booth with lower commission. At a certain sales volume, the larger booth becomes the smarter choice.

For instance, Basic Shopify has a higher online transaction fee (2.9% + $0.30) compared to the Shopify plan (2.6% + $0.30). This small difference can lead to significant savings as your sales grow. At a specific sales volume, the $50 monthly difference between Basic and Shopify is entirely offset by the reduced transaction fees. This is the break-even point. Exceeding it makes the Shopify plan more profitable. Similar logic applies to Advanced Shopify, though the break-even point is higher due to the increased monthly cost.

Leveraging Shopify POS For Optimized Transactions

Besides online sales, optimizing how much Shopify takes per sale involves using Shopify POS. In-person transaction fees are typically lower than online fees. This creates opportunities for businesses with both online and offline sales channels.

For example, encouraging local pickups can leverage lower POS rates. This also allows for upselling and improved customer relationships.

Tailored Strategies for Seasonal Businesses and Multi-Channel Sellers

Seasonal businesses with fluctuating sales face particular challenges. During peak seasons, the higher fees on the Basic Shopify plan can cut into profits. Knowing your peak sales volume helps you plan upgrades to minimize these fees during key periods. You might be interested in: Shopify vs. Etsy to explore multi-channel strategies.

Similarly, multi-channel sellers must analyze fees across all platforms. Balancing different fee structures optimizes overall profitability. This may involve prioritizing specific channels based on their fee structures and profit potential.

Negotiating Enterprise-Level Rates and Custom Solutions

High-volume merchants can explore custom enterprise rates with Shopify. This less-publicized option is worth considering for businesses with a large number of transactions. It involves directly negotiating with Shopify for a tailored pricing plan. This can result in significant long-term cost reductions.

Shopify Vs. Competitors: A True Fee Comparison

When considering how much Shopify takes per sale, it’s important to compare it to other platforms. This section provides a comparison of transaction costs across major ecommerce competitors like WooCommerce, BigCommerce, Etsy, and Amazon. We’ll look beyond the basic fees and examine the complete financial picture, including hidden costs.

Unmasking Hidden Costs: More Than Just Transaction Fees

Shopify’s per-sale fees are transparent. However, other platforms often have hidden costs that can significantly impact your profits. These can include hosting, security, extensions, and maintenance. For example, WooCommerce requires separate hosting, security certificates, and potentially several extensions. All of these add to your expenses. In contrast, Shopify bundles these elements into your monthly subscription.

Shopify Vs. WooCommerce: A Cost Breakdown

Let’s look at an example. Imagine you’re selling $1,000 worth of goods each month. With Shopify’s Basic plan at 2.9% + $0.30, you’d pay about $32 in transaction fees, plus your $29 subscription. With WooCommerce, you might pay less in direct transaction fees through your payment gateway. However, you’d also have monthly hosting fees ($10-$100), security certificate costs ($50-$100 annually), and possible extension fees. This can quickly exceed Shopify's total cost. The cheapest option upfront isn't always the best value.

BigCommerce: A Closer Look at Enterprise Solutions

BigCommerce offers a similar all-in-one solution to Shopify. Learn more in our article about BigCommerce vs. Shopify. While their transaction fees are comparable, BigCommerce’s enterprise plans can be more cost-effective for high-volume sellers. For smaller businesses, Shopify's lower-tier plans often provide a better starting point. Choosing the right platform depends on your business needs and projected growth.

Marketplaces: Etsy and Amazon: Fees and Visibility Trade-Offs

Marketplaces like Etsy and Amazon offer increased visibility, but they have their own fees. Etsy charges listing fees, transaction fees, and optional advertising fees. Amazon offers massive reach but takes a large cut of each sale, ranging from 8% to 15% depending on the product category. There are also additional fees for fulfillment services. While these platforms can boost sales, their fees often require higher prices to maintain healthy profit margins. Carefully analyze your profit margins and understand your target audience before committing to a marketplace.

Case Studies: Migrating Between Platforms

Businesses often switch between platforms looking for the best balance of cost and benefits. A clothing retailer might choose Shopify's integrated marketing tools, even with the transaction fees. A digital product seller with lower transaction values might prioritize minimizing costs with WooCommerce. The ideal platform depends on your individual business model and financial goals.

Making the Right Decision: A Cost-Benefit Analysis

Choosing the right platform requires balancing transaction fees against features, ease of use, scalability, and long-term costs. Shopify’s ecosystem, despite its fees, often provides better value for businesses needing a streamlined, all-in-one solution. This includes marketing tools, secure hosting, and customer support. For businesses with technical expertise and a willingness to manage multiple services, alternatives like WooCommerce might be suitable, especially for high-volume, low-margin products.

Boost your Shopify store’s performance with LinkShop, the ultimate link in bio app for Shopify merchants. Create shoppable link in bio pages and drive more traffic to your store. Learn more at LinkShop.